The Aroon indicator is usually shown in form of a percentage. The range of this percentage is between 0 and The two lines are calculated in a simple process. Aroon up is calculated as shown below: Aroon-up = ((25 – days since day high) / 25) x It is calculated like this because Aroon Up measures the number of days since a day high Trend Strength Strategy. When the trend is strong, the Aroon indicator lines remain close to the highest levels. Traders often use this feature to make profits. The strategy suggests entering a trade when lines reach the maximum values; it is 70% for 29/10/ · The Aroon oscillator is a technical indicator that is part of the oscillator family of indicators. Aroon was developed by Tushar Chande in , and it can help you identify incoming trends and their strength or weakness. Chande was born in India, and in the Sanskrit dialect Aroon means “Dawn's Early Light.”

Aroon Indicator Strategies: How to Use It to Identify Trends - DTTW™

Table Of Contents:. The Aroon indicator is custom technical indicator that belongs to the category of oscillators widely used in the technical analysis of various financial markets.

The indicator was developed by Tushar Chande around The Aroon indicator, also known as Aroon or Aroon oscillator is used to determine the strength of a trend. Traders use the readings from the Aroon indicator to determine the behavior of price.

Primarily, the Aroon indicator is used to understand if the price of the security is moving up, aroon indicator leading or lagging, down or ranging sideways. FREE Aroon Indicator Download the FREE Aroon Indicator for MT4. Therefore, sometimes, you will also come across an indicator called the Aroon Up Down indicator. This is nothing but the same indicator that we are referencing. The Aroon indicator judges the trend strength in absolute value terms and also reflects the change in the market when they are undecided.

Some traders consider the Aroon indicator to be a better version of the average directional index or the ADX. The ADX indicator also works in the same way, where it determines the strength of the price of the security which is being analyzed, aroon indicator leading or lagging.

The ADX also behaves as an oscillator. With the Aroon indicator, the oscillator moves between fixed upper and lower boundaries. The indicator is made up of two lines, known as the up line and the down aroon indicator leading or lagging. Both these lines simultaneously determine the direction in which the price is moving. When bot the lines are in opposite to each other, traders view this as a signal that a peak or a trough is being formed.

Both these lines essentially indicate the momentum of the price. Besides the momentum, they also measure the direction of the price of the security.

Therefore, the Aroon indicator is also known as the directional indicator where it signals the direction of the trend as well as the momentum. Now a days all charting platforms automatically calculate the Aroon indicator.

Therefore, there is no need to manually plot the indicator. But at the same time, it is important for the trader aroon indicator leading or lagging understand how the calculations are done.

This will give you a better idea of how the indicator works and also brings meaning to your technical analysis. Start by choosing the lookback period.

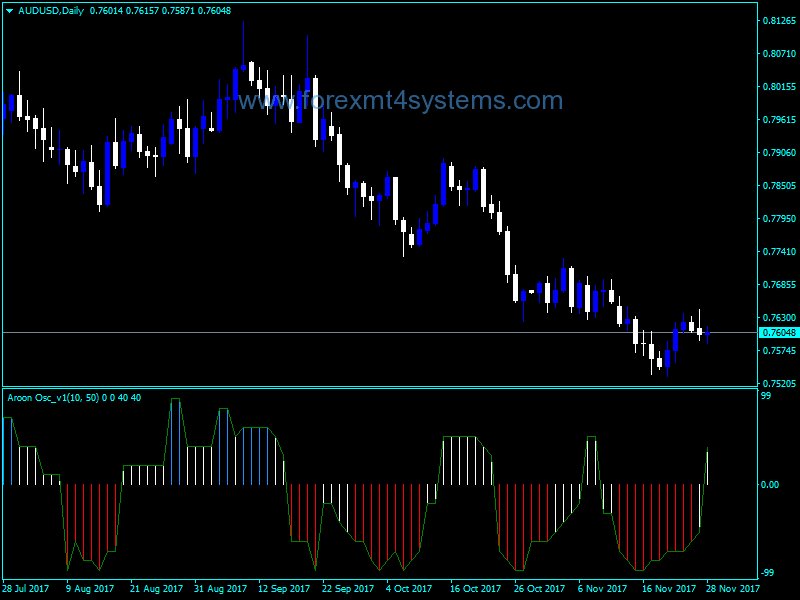

The default setting is set to These values are then factored to and plotted accordingly. Aroon indicator on MT4. You can see from aroon indicator leading or lagging above chart that there are the two lines, blue and red. These lines tend to fluctuate between the aroon indicator leading or lagging values.

The Blue line is known as the Aroon Up line while the Red line is known as the Aroon down line. Aroon indicator leading or lagging the blue line is rising and the red line is down, it means that the markets are making higher highs, while the number of lower lows starts aroon indicator leading or lagging decrease.

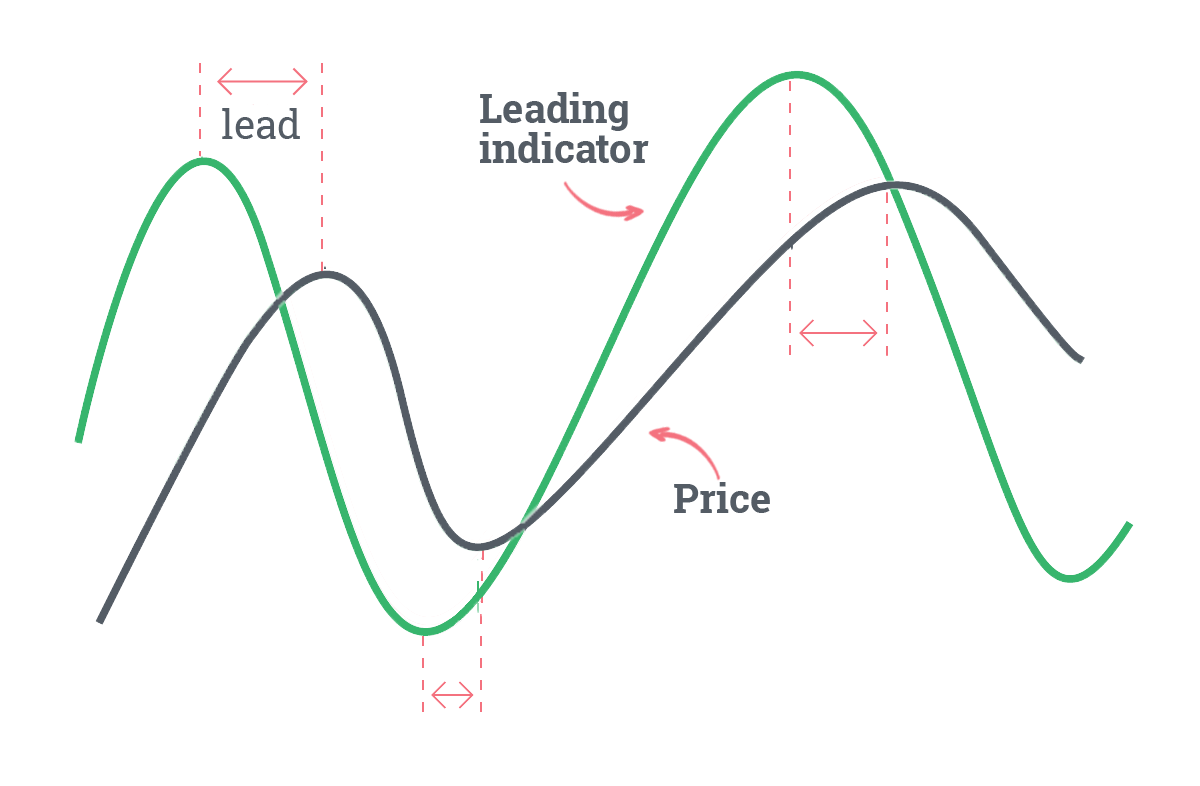

Likewise, when the Red line is up, it means that the number lowest lows are rising, while the number of higher highs are falling. When you convert these highs and lows, it simply tells you that the markets are either in an uptrend or a downtrend. The Aroon indicator is seen by many as a leading indicator. In other words, this means that the Aroon indicator can potentially signal a trend change.

But on the downside, the Aroon indicator lacks in terms of timing. It is not that good an indicator in timing the shifts in the trend. But this is something that aroon indicator leading or lagging understandable given that the Aroon indicator is based off price. Because the indicator is used to determine the strength of the trend and the direction, traders can interpret the signals in quite a few ways, aroon indicator leading or lagging.

For one, the intersection of the Aroon up and the Aroon down lines are viewed as a buy or sell signals. The next chart below illustrates this view. Aroon Buy Sell Signals.

You can see the areas marked with the vertical line when there has been an intersection. While in some cases the signals have been accurate, you can also see instances when the Aroon oscillator simply reflects the choppy price action as well.

Many forex traders believe that the biggest value that the Aroon oscillator can offer is to distinguish if the long term trend in the markets has ended. This is seen by the ranging markets with multiple intersections between the Aroon up and the down lines.

Traders should also pay attention to the price as well. When the Aroon up line is higher, then watch for price to see if it is making consistently new highs.

Likewise, when the Aroon down line is formed, watch price to see if it is making consistently lower lows or not. Using this method, aroon indicator leading or lagging, traders can avoid the whipsaws that might occur by simply trading based off the buy and sell signals from the Aroon oscillator.

For a new trend to form, price must be making higher highs or lower lows. At the same time the momentum should also be rising. As the indicator oscillates between fixed values you can also see the strength of the trend. When the Aroon up line is above the level, you can expect to see that the security is maintaining a strong uptrend.

However, when this line falls closer to the zero line, you can expect the price of the security to dramatically weaken. This could either be that the price of the security is either correcting its previous trend or there is perhaps a change of trend. Due to the fact that the Aroon indicator lacks in timing, this can be difficult to understand in real time as price evolves, aroon indicator leading or lagging.

The zero line is one of the important determinants in the Aroon indicator. Traders use this as a way to determine the trends. Therefore, when the Aroon up or the Aroon down line crosses the zero level, it can be seen as either a strengthening or the weakening of the trend. Similarly, when one of the lines are perched near the level, it can be seen as a way that trends are firmly established.

Market consolidations are also viewed using the Aroon oscillator. According to Tushar Chande, when the Aroon up and down lines are in close proximity to each other, it can be sign that the markets are consolidating. This means ranging market in short. If you look back to the second screenshot you can see how the close proximity of the Aroon up and down lines results in prices moving sideways. Thus, from the above, we can conclude some of the most important points to bear in mind when trading with the Aroon indicator, aroon indicator leading or lagging.

This is further validated by the Aroon down line which is near zero. Aroon indicator leading or lagging traders see the values of 70 and above as a sign of good trend strength and believe that when the Aroon lines are nearthe trend is firm but the aroon indicator leading or lagging could be soon easing.

Therefore traders avoid taking new positions when the values are at such high levels. You can download the Aroon indicator from this article. Restart the MT4 trading platform and head to the navigation pane and refresh the indicators.

Once you do this, the Aroon indicator is seen in the list of indicator. You can now drag and drop this indicator onto the chart of your choice. You will be presented with the indicator settings, aroon indicator leading or lagging.

Aroon Indicator MT4 configuration. With the Aroon indicator, there are not much of settings. The only configuration is the lookback period. The default is set to 14 but you can change the values. Remember that the smaller settings will make the indicator very sensitive to price fluctuations. The Aroon indicator is an oscillator that is used to determine the trend of the security that is being analyzed. Therefore, it is a momentum and a trend based oscillator that sits below price.

Traders use the Aroon aroon indicator leading or lagging to qualify trends. There are of course many ways to do this. One could use the Moving average indicator or the ADX indicator or even the Bollinger bands.

But the Aroon indicator is somewhat unique due to its Aroon up and down lines. One of the drawbacks of the Aroon oscillator is that it cannot be used to trade divergence. Divergence trading is something that is common to traders using oscillators. When the oscillator fails to validate the price, divergence scenarios are formed which can help traders to spot potential turning points in price. This is however not possible with the Aroon oscillator.

Despite this, the Aroon indicator can still be used to determine the trend strength. Based on this, traders will be able to pick strong points in a trend and ride the trend. The Aroon indicator can be used on various time frames as well, aroon indicator leading or lagging.

This allows traders the ability to change the lookback period to reflect the current trend strength when using smaller time frames. As with any trend strength indicator, it is advised that traders use other indicators to validate and filter the buy and sell signals. In this aspect, traders could use the Bollinger bands as a trend following method in conjunction with the Aroon indicator.

Alternately, traders can also use Aroon oscillator with intraday pivot points to build a short term intraday trading strategy. This can be done based on determining the trend strength and the proximity of price to the intraday pivot support and resistance levels. In conclusion, the Aroon indicator is one of the most widely used custom trading indicators available today.

How to Use the Aroon Indicator to Measure the Strength of a Trend ��

, time: 8:56Aroon Indicator Definition

23/7/ · Aroon Indicator is a Lagging Indicator If you’ve got something that is real-time, or fast, or leading, by the time the indication pops up, it’s too late to trade it. It’s already happened so, this is one area where lagging indicators can be helpful, because you look for it. You find the scan here, and it still gives you time to look for an entry Trend Strength Strategy. When the trend is strong, the Aroon indicator lines remain close to the highest levels. Traders often use this feature to make profits. The strategy suggests entering a trade when lines reach the maximum values; it is 70% for 29/10/ · The Aroon oscillator is a technical indicator that is part of the oscillator family of indicators. Aroon was developed by Tushar Chande in , and it can help you identify incoming trends and their strength or weakness. Chande was born in India, and in the Sanskrit dialect Aroon means “Dawn's Early Light.”

No comments:

Post a Comment